News Hub

VAT Representatives Explained: Expand Your Business

What is the difference between VAT Representative and VAT Agent?

The major difference is that HMRC cannot hold your agent responsible for any of your VAT debts. Whilst an agent can help you with your application process, the can not act as a guarantor for your VAT debts.Why appoint a VAT tax representative? People often ask, “Can I forego appointing a tax representative?”

Under certain circumstances, it is possible. If you do not appoint a VAT tax representative, as a taxpayer, you must handle all matters with the UK Tax Office by yourself, such as registering for VAT in time, keeping all transaction data, filing and paying all taxes on time and, when the tax office asks, provide the requested data. However, according to legal requirements, HMRC has the right to require you (especially overseas sellers) to appoint a VAT tax representative, otherwise it will not accept any UK VAT application.When do I need to appoint a VAT tax representative?

As long as HMRC has not directed you to appoint a tax representative, you can appoint an agent to deal with your UK VAT affairs. Any arrangement you make will be subject to whatever contractual agreement you and your agent decide. However, HMRC reserve the right not to deal with any particular agent you may choose to appoint. In some circumstances, if HMRC think it’s necessary, they may still insist that you appoint a tax representative.HMRC will inform you that you must fill the VAT1TR form to appoint a UK VAT representative.How to appoint a VAT tax representative?

An overseas company designated by HMRC to appoint a VAT tax representative must find a tax representative on its own. The tax representative must be a local organization in the UK and must meet the requirements for being a representative (VAT Notice 700/1, S1 & HMRC: the standard for agents). Your appointed representative needs to fill out a special form (VAT1TR) and might need to provide a survey letter (High Risk Traders Import Questionnaire). These two documents must be mailed to the relevant department of HMRC together, and a scanned copy must be sent to their designated mailbox.If I want to appoint a VAT tax representative, are there any special considerations?

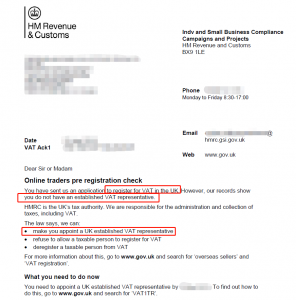

After receiving the notification document from HMRC, you need to respond to HMRC within seven days to confirm who is your appointed VAT tax representative and provide them with the two designated documents. It is important to note that the HMRC normally does not accept any extension applications here. If there is no response within the prescribed period, the tax authority will reject your VAT application and may not consider accepting your second application.J&P Analysis

Now for overseas VAT applicants, HMRC requires them to appoint a tax representative who can bear joint liability. This is not an easy task in the UK, but this is not a novelty. Obviously, this measure is imperative. First of all, in terms of the application rules of VAT itself, in fact, when registering for VAT, the application form VAT1 already requires the applicant to provide the detailed information of the VAT tax representative or VAT tax agent. If in this context, you did not choose a VAT tax representative, then HMRC may write to you again, requesting you to appoint a VAT tax representative (see the official requirement below). Furthermore, from the perspective of the VAT tax representative measures, some EU countries have already implemented this policy. For example, cross-border sellers who register to apply for an Italian VAT number should know that only after paying a certain amount of deposit to the tax representative, your application can be submitted to the Italian Tax Agency. From the current VAT policy, since March 2018 the UK has implemented joint liability clauses for all e-commerce marketplaces. In 2019, HMRC began to randomly require some overseas VAT applicants to implement VAT Representative measures. Finally, it is worth bearing in mind that the UK Revenue Service lost approximately £1.5 billion in taxes in 2017 due to e-commerce VAT fraud. Recently, HMRC has released a blacklist of overseas tax evaders. At the top of the list is a overseas company with a VAT debt of several million pounds. Faced with such a severe situation and under pressure from all walks of life, the British tax authorities have been perfecting and implementing various tax supervision and tax inspection policies.

Furthermore, from the perspective of the VAT tax representative measures, some EU countries have already implemented this policy. For example, cross-border sellers who register to apply for an Italian VAT number should know that only after paying a certain amount of deposit to the tax representative, your application can be submitted to the Italian Tax Agency. From the current VAT policy, since March 2018 the UK has implemented joint liability clauses for all e-commerce marketplaces. In 2019, HMRC began to randomly require some overseas VAT applicants to implement VAT Representative measures. Finally, it is worth bearing in mind that the UK Revenue Service lost approximately £1.5 billion in taxes in 2017 due to e-commerce VAT fraud. Recently, HMRC has released a blacklist of overseas tax evaders. At the top of the list is a overseas company with a VAT debt of several million pounds. Faced with such a severe situation and under pressure from all walks of life, the British tax authorities have been perfecting and implementing various tax supervision and tax inspection policies. J&P Help

In our further communication with the UK Tax Office, it was confirmed that the current VAT tax representative policy is only selective verification and implementation, and it is only implemented for some overseas new VAT applicants. However, it particularly emphasized that this policy will be implemented in existing overseas VAT registered enterprises in the near future and the VAT tax representative policy will gradually become more and more common. In order to avoid complicated procedures and to get your UK VAT registration as soon as possible, we still encourage everyone to register and declare UK VAT as soon as possible. J&P is a registered accounting firm in the UK. We have the qualifications and strength to help you plan ahead, so please do not hesitate to get in touch at enquiries@jpaccountant.com should you have any further questions about this policy, or if you need any help with your applications to register for VAT.

Daily News Round up 14th-18th

Daily News 14th December 2020

E-commerce News: Primark Reject E-commerce Claims

Paul Marchant, CEO of Primark, disputes claims that consumers are shifting permanently to online shopping amidst the coronavirus pandemic. He calls the claims ‘wrong and naïve’. He went on to call for more support from the government for brick-and-mortar shops.

J&P Comments

Despite these comments, it is impossible to ignore the findings that show UK consumers continuing to shop heavily online. In January and February of this year, ecommerce sales accounted for about 20 percent of total retail sales, but in May this increased to 32.8 percent. And in October, it was still at 28.1 percent.

VAT News: UK VAT Recovery Deadline Extended

Ordinarily, overseas non-EU businesses would be required to submit their certificate of status, along with their application for refunds, on or before the 31 December 2020. However, due to the unforeseen struggles that have been placed upon businesses, the HMRC have given these businesses an additional 6 months to produce a valid certificate of status.

J&P Comments

This now means certificates of status must be submitted by the 30th June 2021. Whilst this will come as a relief to many businesses, business owners must note that the deadline for applications of VAT refunds and all other documentary evidence is still the 31st of December 2020.

Business News: Brexit Talks Extended

The Brexit talks had been scheduled to conclude on Sunday, but these talks have now been extended. Whilst there has been no new deadline given, they obviously must conclude before 31st December 2020. As it stands, both sides are supposedly ‘far apart’ in their stances.

J&P comments

It is becoming increasingly unclear as to whether we will see the UK and EU reach an agreement before the deadline. Boris Johnson has recently claimed that WTO terms, such as the trade terms that Australia have with the EU, currently look like the most likely outcome.

Daily News 15th December 2020

E-commerce News: Half Of Retailers Experiencing Supply Constraints

So-called territorial supply constraints are causing wholesalers and retailers severe supply constraints. These constraints could feasibly contribute to the fragmentation of the single market, and are said to mainly affect online vendors.

J&P Comments

Problems with internal structures have been cited as a possible reason for these supply constraints. But the wide range of prices charged across the European Union by manufacturers to retailers can’t be fully explained by factors such as different tax regimes or labor costs. The EU is likely to attempt to solve this problem as soon as possible.

E-commerce News: German E-commerce Could Grow To 141bn euros

After benefitting from the coronavirus, it is being speculated that German e-commerce could grow to become worth up to 141bn euros by 2024. This year saw record breaking online sales in Germany, with yearly sales around 88bn euros.

J&P Comments

The strong growth that has been caused by the pandemic certainly looks likely to continue in Germany. According to calculations from IFH Cologne, the online share of retail should be a 16.5% in 2024, and could even rise to 19.5%.

Business News: China Export Control Law Comes Into Effect

The China Export Control Law has come into effect this month. The law, which is similar to the EU’s Export Control Regime, covers, among others, dual-use items, military items and sensitive technologies.

J&P comments

To be able to export controlled items, exporters are required to apply for relevant licenses from the competent authority in China. In addition, the exporter needs to submit end-user and end-use documents of controlled items to the export control management authority.

Daily News 16th December 2020

Business News: Confidence Growing On A Deal

The European Commission President Ursula von der Leyen has claimed that there is now a ‘path to an agreement.’ This suggests she is more confident than Boris Johnson, who still seems to think that a no-deal Brexit is the most likely outcome.

J&P Comments

There is a lot of conflicting reports at the moment regarding the probability of a deal being struck, however, since there is an estimated one trillion dollars of annual trade free of tariffs and quotas on the line, it still seems likely that Britain will find a way to protect this trade beyond Dec. 31.

E-commerce News: MikMak Launches In Europe

The highly impressive ecommerce marketing startup MikMak has launched in Europe and Canada. The platform allows users to access their ecommerce enablement and analytics software, and claims to boost online sales for its users drastically.

J&P Comments

It’s been a good year for MikMak, which already saw its revenue grow over 200 percent this year. The company, launched in 2015, started as a mobile video shopping network making infomercials. But in 2017, it pivoted to enterprise software to help brands better measure ecommerce marketing.

Business News: Britain And Mexico Agree Trade Deal

With the Brexit deadline looming, Britain have signed an agreement with Mexico that will see their trading terms remain the same after Brexit, as well as an agreement to begin negotiating on a deeper relationship next year.

J&P comments

Britain have signed a few deals like this recently, first with Canada and Japan, and then most recently with the Scandinavian countries. Clearly Britain is attempting to fortify their trade relationships before the Brexit deadline.

Daily News 17th December 2020

Business News: US & UK Strike Deal

Britain and the US have signed a new deal that is concerned with customs processes. The hope is that the new deal will ensure that trade keeps flowing smoothly between the two countries once the UK leaves the EU on Dec 31st.

J&P Comments

It is clear that this deal is merely a precursor to more trade deals that the UK will create with Biden’s US. However, the US have stated that they have much more pressing concerns in their foreign policy, so it is hard to say how long a real trade deal will take.

VAT News: Hainan Cancels VAT For Companies Buying Ships In China

The Hainan authorities have stepped up a policy to reduce the fiscal burden on business and will no longer levy value added tax (VAT) from foreign trade commercial organizations when completing a transaction to acquire a sea vessel from Chinese companies with its subsequent registration in the special customs zone of Yangpu port, reported the Hainan administration.

J&P Comments

These rules are going to be in place until 2024. This will certainly intrigue logistics companies intending to use a sea vehicle in international trade. Interested businesses can electronically submit an application to the competent authorities in order to issue a VAT exemption permit.

Business News: Barnier Confident On Brexit Deal

Barnier, the lead negotiator for the EU has claimed that ‘good progress’ has been made on Brexit talks. These sentiments echo Ursula von der Leyen’s comments yesterday that there was a ‘path to an agreement’.

J&P comments

It looks like the rollercoaster of Brexit is beginning to reach a satisfying conclusion. Whilst it is still too early for complete certainty, the signs are pointing towards a deal being agreed before the deadline. It is reasonable to expect that we will have a clearer idea before the end of the week.

Daily News 18th December 2020

E-commerce News: Amazon Doubles Reach In The Netherlands

Amazon has doubled its amount of users in the Netherlands from last year. The ecommerce giant reached over 7 million Dutch consumers in November. At the beginning of this year Amazon was only reaching about 3.8 million people in the Netherlands.

J&P Comments

7.3 million people accounts for about 45% of all online users in the Netherlands. A lot ofthis growth has to do with Amazon launching Amazon.nl earlier this year. Whilst its growth is likely to continue, it is still trailing to bol.com, who reportedly reached around 11.6 million in 2020.

Logistics News: Calais Confident Brexit Won’t Cause Issues

According to the port chief of Calais, France’s busiest road freight port, the port is not anticipating any chaos after Brexit, provided businesses follow procedures. As far as he is concerned, the port is ready for the customs formalities that will be put in place.

J&P Comments

Britain formally transitions out of the EU’s customs union and single market at 2300 GMT on Dec 31, after which companies will have to complete customs declarations whether there is a post-Brexit trade deal or not. Businesses shifting goods between Britain and the world’s largest trading bloc have warned of major disruption to just-in-time supply chains.

E-commerce News: Gucci Joins Alibaba’s Luxury Ecommerce Site

Gucci, one of the most recognizable fashion brands in the world, will be opening two flagship stores on Alibaba’s online luxury shopping platform. The move highlights the importance of the Chinese market for brands hoping to reverse a fall in revenue due to the pandemic.

J&P comments

China – where consumers shop far more by mobile phone apps than in the United States or Europe – has been a rare bright spot for luxury goods brands this year, with sales surging there since lockdown measures began to ease in the spring. Chinese customers already represented around 35% of luxury goods purchases before the pandemic and are now expected to account for almost half of global sales of high-end clothes, handbags and jewellery by 2025, according to consultancy Bain.

What Brexit Means For The Future Of Ecommerce

Brexit will affect countless industries, but perhaps none more so than ecommerce. Previously, the UK’s member status in the EU ensured the free movement of goods between the UK and the rest of Europe. Unfortunately for ecommerce sellers in the UK and the EU, this is all about to change. Not only will there be the introduction of tariffs, there will also be the need in some cases for the selling company to register for VAT in the countries that they sell to. Read on to find out how your company will be affected, and what you need to do to prepare for Brexit, regardless of the outcome.

Who Accounts For And Pays The VAT After Brexit?

Essentially, the answer to this question depends on who and where you are selling a product to. In the case of B2B distance sales, then the customer is usually responsible for paying the VAT on import. However, in the case of B2C, you would be expected to pay VAT in the place of sale.

As an ecommerce seller, you have two choices here though. You can opt to pay the import VAT and customs duty yourself (usually you would increase the price of your product to reflect this), or, whilst it is not common you do have the option to shift the burden on to the consumer, who would only be shown the price of delivery and then they would have to pay VAT to the courier.

Bear in mind that these rules are extremely complex so please feel free to contact as us here at J&P accountant so we can advise you directly on your specific situation.

Do You Have To Register For VAT In EU Countries And Have A Fiscal Representative After Brexit?

The short answer is yes. Previously, there was a distance selling threshold for each EU member state and so you only had to worry about this as a UK ecommerce seller if you exceeded a certain amount. This threshold will no longer apply once for UK sellers from the 1st of January 2021.

The EU VAT Ecommerce Package one-stop-shop rules will come into place from July 2021 which will limit this need, but in the meantime sellers should think very carefully about which countries they want to sell to. Company’s such as Germany, have difficult VAT deferral systems which might make VAT compliance very difficult before July 2021.

In a lot of states you will also need to appoint a fiscal representative (19 out of the 27). This is essentially an agent or accountant in the state who will be responsible for handling your VAT payments. It is thus vital you check the rules and regulations for each state you will be supplying to.

In the case of foreign exporters selling into the UK, you too will have to register with the HMRC to pay import tax to the UK. The current low-consignment threshold of £15 is being abolished from January 1st 2021 so all importers will have to register with the HMRC.

Sales On An Ecommerce Online Marketplace

As stated earlier, from 1 January 2021 the UK’s low value consignments exemption for goods not exceeding £15 in value will be withdrawn. This will make all imports subject to import VAT (and potentially customs duties). At the same time, a small consignment import simplification process will be put into place and online marketplaces (OMPs) must start accounting for VAT on behalf of suppliers that use their platforms. Ecommerce sellers will be happy to here that a simplification will be available from 1 January 2021 for low value consignments where the total value of the goods (not the individual value of each item) does not exceed £135, excluding shipping costs and duty.

It is worth reiterating that EU suppliers must register with HM Revenue and Customs and charge VAT at UK rates at the point of sale and then account for the VAT using normal VAT return procedures. The goods will then not be delayed by the requirement for VAT to be charged by customs at the point of entry.

Amazon and Ebay will be changing their current rules on cross border fulfilment also. This means it would be very wise for ecommerce sellers to split their inventories between the UK and the EU.

We Are Here To Help Ecommerce Sellers

Here at J & P Accountants, we understand that the prospect of preparing your business for Brexit can be daunting; but that’s where we come in.

If you are a business who participates in cross border e-commerce, we would be more than happy to help you register for the VAT deferral scheme, file your VAT returns, and help you comply with VAT in case your account faces any issues. We even offer warehouse storage across in the UK and Europe.

At J&P, helping your business is our passion, and we understand that companies across the UK are at risk now more than ever. We are here to support you through the Coronavirus crisis and Brexit, so please do not hesitate to give us a call on 0161 637 1080 or send an e-mail to enquiries@jpaccountant.com.

Services VAT After Brexit: What We Know So Far

The Brexit deadline is fast approaching and each day seems to bring new speculation on whether the UK and the EU will actually come to an agreement or not. As it stands, both sides are calling on the other to compromise, and neither side seem particularly optimistic about the prospect of a deal being reached. Regardless, the government have still released a wide range of support and guidance on the implementation of VAT post-Brexit when it comes to goods and imports. What has been less clear, however, is the implementation of VAT on services. This article will provide an update on what we know so far, as well as provide some advice on how to prepare your business for Brexit. For advice on VAT on goods, please take a look at our other articles here.

Services VAT on Business-To-Business Supplies

It will come as welcomed news to those participate in cross-border B2B services selling that there is likely to be very little change to the current rules on regarding services VAT. Services purchased from outside the UK and received in the UK are still liable to the reverse charge as they are now. Following Brexit the supply will still be deemed to take place in that country, because that is the current rule for supplies of services to persons outside the EU.

It is also worth noting that the need to complete EC Sales Lists ends on the 31st of December 2020.

Also, there are some services that will require UK businesses to register for VAT in other EU member states; these services include services connected with immovable property and admission to events.

Services VAT On Business-To-Consumer Services After Brexit

The rules are slightly trickier when it comes to Services VAT on B2C transactions. Services provided to EU consumers from the UK after 31 December 2020 will be zero-rated. As the place of supply under EU law is the UK, they should not be VATable in the country in which the customer lives either. Accordingly, there will be no requirement to register for VAT in that country.

Thus, the general rule is that the tax should be paid to where the supplier is located.

However, in the case of digital services, this shifts and the tax is instead owed to the place of the consumer.

In the case of services supplied from EU countries to the UK, the reverse charge régime will continue to apply in the same way as it does at present for supplies of services from businesses outside the EU, for example from the USA, India or Australia.

Northern Ireland

In the case of Northern Ireland, Services are excluded from the Northern Ireland Protocol, so sales of services between Northern Ireland and the Ireland/EU from 1 January 2021 will be treated like Third Country supplies.

Again, this represents very little change to services VAT which will come as a relief to suppliers. Further, supplies of services between Northern Ireland and the UK will continue to be considered domestic supplies. You can read more about that in our previous article here.

Conclusion

The general message is there is going to be very little change to the current VAT rules. However, it will certainly be worth keeping an eye on developments with the Brexit negotiations in turmoil and the government still yet to be completely clear on the rules regarding VAT on services.

If you are a business who participates in cross border e-commerce, we would be more than happy to help you file your VAT returns, and help you comply with VAT in case your account faces any issues. At J&P, helping your business is our passion, and we understand that companies across the UK are at risk now more than ever. We are here to support you through the Coronavirus crisis and Brexit, so please do not hesitate to give us a call on 0161 637 1080 or send an e-mail to enquiries@jpaccountant.com.

Daily News Round Up Dec 7th-11th

Daily News 7th December 2020

E-commerce News: JD.com To Accept China’s Digital Currency

JD.com Inc has become the first ecommerce platform in China to accept the country’s homegrown digital currency. According to a post of the company’s official WeChat account, the company’s fintech arm JD Digits will accept digital yuan as payment for some products on its online mall.

J&P Comments

China’s digital yuan is one of the world’s most advanced “central bank digital currency” initiatives, as authorities globally respond to threats from private currencies such as bitcoin and Facebook’s Libra. Supposedly, over 4 million transactions have already took place using the digital currency.

VAT News: GB To NI Customs And VAT To Be Clarified

On the 9th of December the UK government will present its ‘Taxation (Post Transition Period) Bill 2019-21’ to Parliament. The Bill is concerned with the customs duties and VAT treatment of goods moving between the two countries.

J&P Comments

The Bill will likely also have concessions depending on the outcome of the Brexit negotiations. However, it is possible that the bill could undermine the fragile final stages of the Brexit negotiations, as the Bill could contravene the Protocol settlement.

E-commerce News: China’s Exports Soar

It had already been clear that China’s fast recovery from the pandemic had meant that it was outpacing the reopening seen in other countries, and this trend shows no signs of stopping as China’s exports rose to at the fastest pace in almost three years in November.

J&P comments

Exports in November rose 21.1% from a year earlier, customs data showed on Monday, the fastest growth since February 2018. It also soundly beat analysts’ expectations for a 12.0% increase and quickened from an 11.4% increase in October. It is likely this growth is due to the demand for protective equipment around the world, as well as electronic products for working at home.

Daily News 8th December 2020

Logistics News: Additional Data Element Required For Goods Held In Temporary Storage

The HMRC have announced that when goods held in Temporary Storage, or entered to a Special Procedure, are subsequently released to free circulation from 1 January 2021, traders will be required to enter a mandatory AI code in box 44 of their customs declaration. The code will be GEN53.

J&P Comments

All Customs Handling of Import and Export Freight (CHIEF) traders importing goods into Temporary Storage or a Special Procedure, which are subsequently released to free circulation, are affected by these changes. The changes apply from 1st of January 2021 to 31st of December 2021.

E-commerce News: JD Health A Big Hit

The Chinese ecommerce giant JD have expanded their services to include pharmaceuticals and healthcare in the shape of JD Health. On its trading debut in Hong Kong, its stock opened at HK$94.50 (£9.13 ; $12.19), well above the list price of $9.11. The company raised $3.48bn and was valued at $29bn ahead of its trading debut.

J&P Comments

The company is clearly hoping to cash in on China’s large and growing market for health services and pharmaceuticals, similarly to how Amazon are trying to do in the US with Amazon Pharmacy. According to the consultancy Frost and Sullivan, China is the world’s second-largest market for health care, reaching $998bn in 2019.

E-commerce News: Indian E-commerce Strong Despite Pandemic

It is being estimated that India has had an increase of 30-40% of new shoppers on online marketplaces. It seems as though the pandemic has created a shift in the needs of consumers. India has a similar tier system in place to the UK, and thus online sales of groceries have soared.

J&P comments

The performance of the ecommerce in India has surpassed all expectations. RedSeer in its report said the gross ecommerce sales starting from mid-October till November, touched $8.3 billion as compared to $5 billion in 2019. It had earlier estimated that the festive season would bring in $7 billion in gross sales.

Daily News 9th December 2020

VAT News: Norway To Replace Current VAT Return System

From 2022, Norway is going to be replacing their current manual VAT filing with SAF-T VAT reporting. This will include direct digital submission from accounting systems. The new Norwegian SAF-T VAT report will extend from the exiting 19 boxes to at least 30 boxes and covers all accounts with VAT transactions.

J&P Comments

SAF-T was developed by the OECD in 2005 to harmonise the exchange of tax information between the tax authorities and businesses. It’s aim is to ensure some uniformity of standards around digitally based transactional reporting. Around 12 EU countries have implemented SAF-T reporting, although the harmonisation has been limited and confusing for businesses.

Business News: Britain Ready To Compromise On Brexit Deal?

Senior minister Michael Gove has claimed that the UK may be willing to compromise slightly on fishing, an issue that has been highly contentious, but stresses that the EU must also be willing to be more accommodating. The compromise on fishing would come in the form of the way in which European boats could continue to access British waters.

J&P Comments

These comments are interesting, as they show that the UK is trying extremely hard to reach a deal. It seems that the UK is trying to establish similar rules to those that can be seen in countries like Iceland and Norway who have control over who enters their waters.

VAT News: Indonesia Enacts Job Creation Law

Amongst other things, the law made changes to the treatment of VAT. Goods under consignment arrangements and in-kind contributions made in exchange for shares are no longer subject to VAT at 10%. However, coal mining products are now subject to VAT at 10%.

J&P comments

The Job Creation Law also enables input VAT to be creditable in the following situations to improve companies’ cash flow:

- Input VAT is paid by a company prior to the company being registered for VAT.

- Any input VAT which: (i) has not been reported in the monthly VAT return but is identified during a tax audit; (ii) collected by a tax assessment; or (iii) paid by the company during its pre-operating stage

Daily News 10th December 2020

Business News: UK and Singapore Sign Free Trade Agreement

Singapore and the UK have signed a free trade deal that will cover a trade relationship that is worth more that £17bn. The deal is very similar to Singapore’s deal with the EU, and gives both countries access to each other’s markets in services.

J&P Comments

This deal is part of a broader set of trade negotiations for the UK, as it tries to replicate trade pacts which will cease when the EU transition period ends. Earlier in the week the UK signed similar continuation deals with Norway and Iceland.

E-commerce News: Chinese E-commerce Platforms Given More Responsibility

As online food purchases have become more popular due to the pandemic, the Chinese Supreme Court have ruled that e-commerce platforms can now be held legally responsible for food safety issues. From the beginning of next year, e-commerce platform operators will be required to conduct real-name registration for vendors selling food products and to review the latter’s business licenses.

J&P Comments

Reports have suggested that over 62% of China’s e-commerce users shopped online for packaged food products this year. This has meant that a lot of e-commerce platforms have improved their logistics in order to distribute food, and this new regulation just helps to protect the consumers.

Business News: Brexit ‘Last Supper’ Unsuccessful

Many hoped that the meal between Boris Johnson and European Commission President Ursula Von Der Leyen would result in some headway being made in the Brexit negotiations. However, it seems the exercise was unsuccessful as the sides are said to still remain ‘far apart’.

J&P comments

At least this meeting will hopefully give both sides some added clarity as to the opposite sides’ position. However, it is worrying that no headway was made. There has been reports that the UK are hoping to get a deal done by the wweekend, but this seems highly unlikely.

Daily News 11th December 2020

VAT News: Germany Extend Deadline For Import VAT

Germany have extended the deadlines for importers to pay VAT. Under the new rules, the import VAT will have to be paid on the 26th day of the second month following the month of importation (instead of the 16th day of the month following the month of importation).

J&P Comments

This new directive will certainly help importers into Germany since the country offers no form of Postponed Accounting. To benefit from the extension though you will have to set up a deferment account with the German tax authorities.

VAT News: Vietnam & Britain To Sign Post-Brexit Deal

Today Britain and Vietnam concluded talks on a post-Brexit trade deal. The deal will reportedly ensure that Britain does not lose preferential tariffs in one of the fast growing economies in Asia, and will replace the exisiting EU-Vietnam Free Trade Agreement for Britain..

J&P Comments

Whilst it is not clear exactly when the deal will be signed, it does seem imminent. This will certainly cement trade relations between Britain and Vietnam, which is a trade relationship that has tripled in last decade to be worth about $8 billion.

E-commerce News: Ebay Still Delivering On Time

Whilst the online marketplace has warned sellers to anticipate delays, they claim that so far most of their orders are still arriving on time over the festive season. They also have informed sellers that late deliveries this season will not impact a sellers’ performance rating.

J&P comments

The pandemic and subsequent surge in e-commerce activity has meant that most vendors and retailers are expecting heavy delays over the festive period. However, ebay seem to be weathering the storm thus far, and their assurances for their seller’s ratings will come as welcomed news.

SIVA: How To Use Simplified Import VAT Accounting

Our last article outlined how you can use the Import VAT and Duty Deferral scheme to make it easier to pay your VAT when importing after Brexit. However, one of the limitations of the scheme was that you needed a guarantee from your bank or building society in order to gain access to the scheme. A Simplified Import VAT Accounting account (SIVA) will allow the holder to gain access to the Import VAT and Duty Deferral scheme without a guarantee for your VAT. Read on to find out how a SIVA account works and how to get one.

What Is SIVA?

Essentially, SIVA enables a company or agent to operate a VAT and duty deferment account without a guarantee for the VAT element, therefore reducing the compliance cost to the business. The new Import VAT and Duty Deferral scheme is essentially an extension of the SIVA scheme that has made it more useful for life after Brexit.

The main difference between the two schemes is that SIVA requires you to have been a registered importer with a clean VAT history for the last 3 years in most cases, whereas new importers can use the deferral scheme but their guarantees will be required to be much higher.

The HMRC have now amended the SIVA scheme to allow for importers without 3 years compliance history to apply, but they cannot be new importers and they will have to undergo considerably more financial and credibility checks.

The new scheme also allows you to defer duty payments, whereas the SIVA scheme only allows the deferral of VAT payments.

It is worth noting that you can apply for both of these schemes at the same time in order to use them in combination with each other.

How To Apply

First things first, to get approval for a SIVA account, your business needs to have a good system of control over its operations and flow of goods. Further, as previously stated, it is ideal that you would have been registered for VAT for 3 years or more.

It is also worth pointing out that you can NOT apply for SIVA if you:

- owe money to HMRC

- have been charged with a serious offence by HMRC

- have defaulted on deferment account payments more than once in the last 12 months

- have incurred any default surcharges in the last 12 months

- have transferred the business as a going concern in the last 3 years – unless the transfer happened because of a change in legal status, such as becoming a limited company.

If none of the above criteria applies to you, you should feel free to apply. You will need to complete and send the simplified accounting application form and questionnaire to the HMRC.

Due to the pandemic, the HMRC have communicated that applications should be made by email and a supporting copy sent by post until further notice.

Once you’ve sent your application, be warned that the HMRC may need to see your accounts for the last three years and may ask for a credit check on your business. In order to ensure the process is completed as quickly as possible, it is worth getting this information to hand as soon as you send off your application.

Once this is done, if you are accepted (you will be notified by letter if you are) then all that is left to do is to fill in a deferment schedule with details of the amount you’ll be deferring each month. If you do not send this form to HMRC within 6 months of your approval letter, your approval will be cancelled and you’ll have to apply again.

Need Help Deferring VAT With SIVA?

Here at J & P Accountants, we understand that the prospect of preparing your business for the application process and then contacting the HMRC can be daunting; but that’s where we come in.

If you are a business who participates in cross border e-commerce, we would be more than happy to help you register for the VAT deferral scheme, file your VAT returns, and help you comply with VAT in case your account faces any issues. At J&P, helping your business is our passion, and we understand that companies across the UK are at risk now more than ever. We are here to support you through the Coronavirus crisis and Brexit, so please do not hesitate to give us a call on 0161 637 1080 or send an e-mail to enquiries@jpaccountant.com.