News Hub

The Weekly Daily News Round Up 2nd-6th November

E-commerce: Usage of Paypal highest in the UKData from AirNow has shown that the UK uses Paypal more than any other European country, with over 330,000 daily users. Germany and France make up the rest of the top 3, with over 312,000 and 96,000 daily users respectively. These standings make sense when one considers the fact that these 3 countries are the 3 biggest ecommerce markets in Europe.J&P CommentsThis report follows data from 2019 that showed that Paypal was the most used online payment method in the UK, with 49% of online shoppers using the app to make online purchases. One of the reasons for Paypal’s success in Europe is surely the fact that it allows for payments across borders – domestic payment providers should consider doing the same.

E-commerce: Usage of Paypal highest in the UKData from AirNow has shown that the UK uses Paypal more than any other European country, with over 330,000 daily users. Germany and France make up the rest of the top 3, with over 312,000 and 96,000 daily users respectively. These standings make sense when one considers the fact that these 3 countries are the 3 biggest ecommerce markets in Europe.J&P CommentsThis report follows data from 2019 that showed that Paypal was the most used online payment method in the UK, with 49% of online shoppers using the app to make online purchases. One of the reasons for Paypal’s success in Europe is surely the fact that it allows for payments across borders – domestic payment providers should consider doing the same.  E-commerce: Tmall Global flourishing despite Coronavirus More Than 10 million people visited Tmall Global over the 6.18 Mid-Year Shopping Festival. This resulted in a 43% increase of gross merchandise volume of imported products sold on the platform compared to last year. Products imported from Germany (mainly cosmetic products) were the some of the most popular, as well as products from Korea, Japan, America and Australia. Tmall Global is proving itself to be an ideal platform for foreign brands to reach Chinese consumers.J&P commentsThe shopping festival also showcased how effective livestreaming can be when trying to attract new, younger customers. This year, the German cosmetic brand Cosnova had an increase of 25% in their sales from last year. Livestreaming was a big factor in this increase, with 97% of sales made via the stream being from new customers.

E-commerce: Tmall Global flourishing despite Coronavirus More Than 10 million people visited Tmall Global over the 6.18 Mid-Year Shopping Festival. This resulted in a 43% increase of gross merchandise volume of imported products sold on the platform compared to last year. Products imported from Germany (mainly cosmetic products) were the some of the most popular, as well as products from Korea, Japan, America and Australia. Tmall Global is proving itself to be an ideal platform for foreign brands to reach Chinese consumers.J&P commentsThe shopping festival also showcased how effective livestreaming can be when trying to attract new, younger customers. This year, the German cosmetic brand Cosnova had an increase of 25% in their sales from last year. Livestreaming was a big factor in this increase, with 97% of sales made via the stream being from new customers.  Daily News 3rd November 2020E-commerce: Cross Border trustmark Shopping Secure launchedDutch ecommerce association Thuiswinkel.org has launched Shopping Secure, a trustmark for cross-border e-commerce companies. The international trustmark can be used by both B2C and B2B companies. Upon applying for the Trustmark, companies will be required to pass a series of legal tests to ensure that they adhere to the relevant rules and regulations. The online shop will also be scanned for security leaks. J&P CommentsThe launch of this trustmark has come soon after Amazon’s launch in the Netherlands earlier this year. The Netherlands are clearly attempting to grow their global e-commerce and this trustmark will go a long way in ensuring the safety of online venders and customers.

Daily News 3rd November 2020E-commerce: Cross Border trustmark Shopping Secure launchedDutch ecommerce association Thuiswinkel.org has launched Shopping Secure, a trustmark for cross-border e-commerce companies. The international trustmark can be used by both B2C and B2B companies. Upon applying for the Trustmark, companies will be required to pass a series of legal tests to ensure that they adhere to the relevant rules and regulations. The online shop will also be scanned for security leaks. J&P CommentsThe launch of this trustmark has come soon after Amazon’s launch in the Netherlands earlier this year. The Netherlands are clearly attempting to grow their global e-commerce and this trustmark will go a long way in ensuring the safety of online venders and customers.  Business: Chinese diaper firm set to supply UK with masksChinese diaper firm Daddybaby has just been certified by the British Standards Institution (BSI) and the EU to offer personal protective equipment (PPE). Since the start of the pandemic, Daddybaby has been distributing masks to the people of China after they retooled their production lines in order to create PPE. Already, they have provided over 30 million masks to the Chinese population.J&P CommentsSince the beginning of the Coronavirus outbreak, many firms have shifted their production towards protective equipment. Not only has this created another form of revenue, it has also given them new trading opportunities in different countries, as is evidence by Daddybaby’s new venture in the UK.

Business: Chinese diaper firm set to supply UK with masksChinese diaper firm Daddybaby has just been certified by the British Standards Institution (BSI) and the EU to offer personal protective equipment (PPE). Since the start of the pandemic, Daddybaby has been distributing masks to the people of China after they retooled their production lines in order to create PPE. Already, they have provided over 30 million masks to the Chinese population.J&P CommentsSince the beginning of the Coronavirus outbreak, many firms have shifted their production towards protective equipment. Not only has this created another form of revenue, it has also given them new trading opportunities in different countries, as is evidence by Daddybaby’s new venture in the UK.  E-commerce: De Bijenkorf launches in FranceOn the same day that the Netherlands launched their trustmark ‘Shopping Secure,’ the Dutch omni-channel retail store De Bijenkorf has expanded further into Europe by launching its online store in France. De Bijenkorf (which translates directly as ‘the beehive’) is owned by the Weston family, who also own Britain’s Selfridges, Canada’s Holt Renfrew, and Ireland’s Brown Thomas.J&P commentsConsidering that France’s e-commerce was said to be worth around 100 billion euros in 2019, it is no surprise that Dutch retail store has decided to launch here. With sites already present in Germany and Belgium, and future plans already confirmed for a site to be set up in Austria, it is clear that this company are really investing heavily in to the international market.

E-commerce: De Bijenkorf launches in FranceOn the same day that the Netherlands launched their trustmark ‘Shopping Secure,’ the Dutch omni-channel retail store De Bijenkorf has expanded further into Europe by launching its online store in France. De Bijenkorf (which translates directly as ‘the beehive’) is owned by the Weston family, who also own Britain’s Selfridges, Canada’s Holt Renfrew, and Ireland’s Brown Thomas.J&P commentsConsidering that France’s e-commerce was said to be worth around 100 billion euros in 2019, it is no surprise that Dutch retail store has decided to launch here. With sites already present in Germany and Belgium, and future plans already confirmed for a site to be set up in Austria, it is clear that this company are really investing heavily in to the international market.  Daily News 4th November 2020Business: Marks and Spencers suffers pre-tax loss of £87.6 millionA 15.8% fall in revenue has meant that Marks and Spencer (M&S) have suffered a pre-tax loss of £87.6 million. Whilst the retailer was able a 2.7% growth over the six-month lockdown period, it saw sales drop dramatically by 40.8% in clothing and home, despite online sales in this category rising by 34.3%.J&P CommentsWhilst the losses incurred by M&S are clearly distressing, they will be buoyed somewhat by their online success. This is clearly why the retail-giant have expressed a desire to move towards a business model that is more focused on digital sales. This would seem wise since it was reported in June that online spending had leapt up by 61.9% since pre-lockdown.

Daily News 4th November 2020Business: Marks and Spencers suffers pre-tax loss of £87.6 millionA 15.8% fall in revenue has meant that Marks and Spencer (M&S) have suffered a pre-tax loss of £87.6 million. Whilst the retailer was able a 2.7% growth over the six-month lockdown period, it saw sales drop dramatically by 40.8% in clothing and home, despite online sales in this category rising by 34.3%.J&P CommentsWhilst the losses incurred by M&S are clearly distressing, they will be buoyed somewhat by their online success. This is clearly why the retail-giant have expressed a desire to move towards a business model that is more focused on digital sales. This would seem wise since it was reported in June that online spending had leapt up by 61.9% since pre-lockdown.  Business: Trump administration backs down on plans to blacklist Ant Group.The Trump administration has put on hold an effort to blacklist Ant Group Co Ltd, the Chinese financial technology company affiliated with e-commerce giant Alibaba, following a phone call between a company executive and a top U.S. government official, according to reports.J&P CommentsAnt is China’s dominant mobile payments company, offering loans, payments, insurance and asset management services via mobile app; as such, Ant presents very good stock and trade opportunities for Wall Street. It is perhaps no surprise that Trump was reluctant to antagonize Wall Street, given the fact that they are in the midst of a general election.

Business: Trump administration backs down on plans to blacklist Ant Group.The Trump administration has put on hold an effort to blacklist Ant Group Co Ltd, the Chinese financial technology company affiliated with e-commerce giant Alibaba, following a phone call between a company executive and a top U.S. government official, according to reports.J&P CommentsAnt is China’s dominant mobile payments company, offering loans, payments, insurance and asset management services via mobile app; as such, Ant presents very good stock and trade opportunities for Wall Street. It is perhaps no surprise that Trump was reluctant to antagonize Wall Street, given the fact that they are in the midst of a general election.  Logistics News: Coronavirus impact on global trade prompts ship firms to cut back on new vesselsDue to the uncertain future of global trade, shipping companies are spending less on new vessels, and are instead opting to charter or buy existing ships, according to business insiders and analysts. It has also been speculated that another reason in the reduction could be down to concerns over climate change. Whilst this is bad news for the ship manufacturers, the reduction in the size of the world fleet has led to soaring freight rates.J&P commentsIn October new ship orders as a percentage of the global fleet fell to 7.1%, the lowest level since 1989, according to Clarksons Research. Indeed, this affected China where there was a fall in completed ships exported by 5%. However, it is not all bad news as exports from China inched up 4% in the third quarter from a year earlier.

Logistics News: Coronavirus impact on global trade prompts ship firms to cut back on new vesselsDue to the uncertain future of global trade, shipping companies are spending less on new vessels, and are instead opting to charter or buy existing ships, according to business insiders and analysts. It has also been speculated that another reason in the reduction could be down to concerns over climate change. Whilst this is bad news for the ship manufacturers, the reduction in the size of the world fleet has led to soaring freight rates.J&P commentsIn October new ship orders as a percentage of the global fleet fell to 7.1%, the lowest level since 1989, according to Clarksons Research. Indeed, this affected China where there was a fall in completed ships exported by 5%. However, it is not all bad news as exports from China inched up 4% in the third quarter from a year earlier.  Daily News 5th November 2020Logistics: El Corte Inglés Transforms Stores Into Logistics Centers In order to boost its e-commerce and compete with Amazon, El Cort Inglés has turned 90 of its stores across Spain into logistics centers. The changes will enable them to unify their inventory and to increase their distribution capabilities to a great extent. The Spanish company now has a total of 93 logistics centers.J&P CommentsJust like many companies around the world, El Corte Inglés have adapted their business model to align themselves with a marketplace that is becoming increasingly digitalized. Whilst this trend has been growing steadily for some years, it is clear that the pandemic has increased the rate in which retailers are moving towards a more digitalized business model.

Daily News 5th November 2020Logistics: El Corte Inglés Transforms Stores Into Logistics Centers In order to boost its e-commerce and compete with Amazon, El Cort Inglés has turned 90 of its stores across Spain into logistics centers. The changes will enable them to unify their inventory and to increase their distribution capabilities to a great extent. The Spanish company now has a total of 93 logistics centers.J&P CommentsJust like many companies around the world, El Corte Inglés have adapted their business model to align themselves with a marketplace that is becoming increasingly digitalized. Whilst this trend has been growing steadily for some years, it is clear that the pandemic has increased the rate in which retailers are moving towards a more digitalized business model.  Business: Sainsbury’s To Cut 3,500 Jobs.The announcement of possible job cuts comes as Sainsbury’s announce a half-year loss of £137m. The jobs cuts are said to come in the form of in-store meat, fish and deli counters due to a lack of customer demand, as well as 120 of their Argos stores, as plans to open Argos stores within its supermarkets are accelerated. It is believed that a total of 420 standalone Argos stores could be closed over the next three-and-a-half years.J&P CommentsOnce again, we are seeing another supermarket shift its focus towards online business. This year has seen Sainsbury’s digital sales rise by a staggering 112% to £5.8 billion. It is interesting to see how the pandemic has on the hand caused great losses for supermarkets, whilst simultaneously greatly boosted their online presence.

Business: Sainsbury’s To Cut 3,500 Jobs.The announcement of possible job cuts comes as Sainsbury’s announce a half-year loss of £137m. The jobs cuts are said to come in the form of in-store meat, fish and deli counters due to a lack of customer demand, as well as 120 of their Argos stores, as plans to open Argos stores within its supermarkets are accelerated. It is believed that a total of 420 standalone Argos stores could be closed over the next three-and-a-half years.J&P CommentsOnce again, we are seeing another supermarket shift its focus towards online business. This year has seen Sainsbury’s digital sales rise by a staggering 112% to £5.8 billion. It is interesting to see how the pandemic has on the hand caused great losses for supermarkets, whilst simultaneously greatly boosted their online presence.  E-Commerce News: UK E-Commerce Expected To Surpass $200 bn by 2026The UK continues to be a world leader when it comes to e-commerce. Data from the UK E-Commerce Payment Market Report 2020 has predicted that the country’s e-commerce market is expected to be worth around $203.08 billion by 2026. This is in direct correlation with the fact that digital wallets are expanding as twice the rate of physical payment cards. Paypal continues to be the dominant digital wallet payment option for UK consumers.J&P commentsPart of the reason the UK is showing such growth in their e-commerce market is due to consumers having more trust in technology and online payment methods. The growth of e-commerce is directly related to the growth of smart devices, with over 95% of UK households now having mobile phones.

E-Commerce News: UK E-Commerce Expected To Surpass $200 bn by 2026The UK continues to be a world leader when it comes to e-commerce. Data from the UK E-Commerce Payment Market Report 2020 has predicted that the country’s e-commerce market is expected to be worth around $203.08 billion by 2026. This is in direct correlation with the fact that digital wallets are expanding as twice the rate of physical payment cards. Paypal continues to be the dominant digital wallet payment option for UK consumers.J&P commentsPart of the reason the UK is showing such growth in their e-commerce market is due to consumers having more trust in technology and online payment methods. The growth of e-commerce is directly related to the growth of smart devices, with over 95% of UK households now having mobile phones.  Daily News 6th November 2020Business: Bentley Reveals Plans To Go Fully Electric By 2030 Bentley has shown its desire to become one of the car industry’s leaders in environmental sustainability by revealing plans to be fully electric by 2030. This will be a gradual transition as, before then, the car manufacturer has said it will only be offering plug-in hybrid or battery electric cars by 2026. This news comes as electric car sales have said to have tripled in the UK so far this year.J&P CommentsThis news is a big indication that the automotive industry is really taking their environmental responsibilities seriously. Indeed, it appears consumers are too, since UK electric car sales have nearly tripled so far in 2020 to 76,000. This October was the weakest for nine years in terms of electric car sales, but this is likely a result of Covid-19’s financial implications.

Daily News 6th November 2020Business: Bentley Reveals Plans To Go Fully Electric By 2030 Bentley has shown its desire to become one of the car industry’s leaders in environmental sustainability by revealing plans to be fully electric by 2030. This will be a gradual transition as, before then, the car manufacturer has said it will only be offering plug-in hybrid or battery electric cars by 2026. This news comes as electric car sales have said to have tripled in the UK so far this year.J&P CommentsThis news is a big indication that the automotive industry is really taking their environmental responsibilities seriously. Indeed, it appears consumers are too, since UK electric car sales have nearly tripled so far in 2020 to 76,000. This October was the weakest for nine years in terms of electric car sales, but this is likely a result of Covid-19’s financial implications.  Business: China To Open Up More Trade Deals And Imports.It has been claimed by Chinese President Xi Jinping that China will import more than $22 trillion worth of goods over the next decade. This claim comes as China attempts to accelerate its efforts to reopen the economy after the country managed to bring Covid-19 under control for the most part.J&P CommentsIt is impressive that China is the only major economy to grow this year. Mr Xi described China as the “world’s largest market with the greatest potential” and, after recording growth in the first 3 quarters of this year, it is hard for other countries to argue with China. It will be interesting to see what effect the US presidential election may have on China’s trade with the US.

Business: China To Open Up More Trade Deals And Imports.It has been claimed by Chinese President Xi Jinping that China will import more than $22 trillion worth of goods over the next decade. This claim comes as China attempts to accelerate its efforts to reopen the economy after the country managed to bring Covid-19 under control for the most part.J&P CommentsIt is impressive that China is the only major economy to grow this year. Mr Xi described China as the “world’s largest market with the greatest potential” and, after recording growth in the first 3 quarters of this year, it is hard for other countries to argue with China. It will be interesting to see what effect the US presidential election may have on China’s trade with the US.  Logistics News: UK Furlough Scheme Extended To March 2021The current furlough scheme that was announced earlier this week in the midst of a second UK lockdown is going to be extended to 5 months, ending in March 2021. Further, the two-stage Self-Employed Income Support Grant will be increased from 55% of average trading profits to 80% in its second stage.J&P commentsSome have speculated that the extension of this scheme is an indicator that the UK’s second lockdown will last longer than the current month-long duration. However, this is not necessarily the case. January-March can be very difficult times for businesses and sole traders, and thus the access to further support, should it be needed, will be welcome news to employers and the self-employed.

Logistics News: UK Furlough Scheme Extended To March 2021The current furlough scheme that was announced earlier this week in the midst of a second UK lockdown is going to be extended to 5 months, ending in March 2021. Further, the two-stage Self-Employed Income Support Grant will be increased from 55% of average trading profits to 80% in its second stage.J&P commentsSome have speculated that the extension of this scheme is an indicator that the UK’s second lockdown will last longer than the current month-long duration. However, this is not necessarily the case. January-March can be very difficult times for businesses and sole traders, and thus the access to further support, should it be needed, will be welcome news to employers and the self-employed.

E-Commerce: How Covid-19 Has Changed E-commerce Forever

The Coronavirus has created many problems for businesses and its effects on the economy will be felt for years to come. However, one of the few positive effects it has had on the market is in the e-commerce sector. European e-commerce is expected to be worth around 717 billion euros by the end of 2020, which would represent an increase of 12.7%. Moreover, with more and more businesses shifting their business strategy towards a more digitally-focussed model, it seems that this growth is only going to accelerate over the next few years. This article takes a look at the recent trends in e-commerce, and outlines some ways in which you can adapt your business to be prepared for the post-covid economy.

Consumer Habits Changed Forever Towards E-commerce

Due to people being forced to stay in their homes for long periods and fear of infection in busy shops, 2020 saw the majority of us rely predominantly on online shopping and courier service to obtain products.

Salesforce Inc. found in a global study that 63% of consumers have “transformed” the way they obtain goods and services in 2020. Furthermore, 58% of consumers said they expected to do more online shopping after the pandemic and 80% of business buyers expect to do more business purchasing online.

This shift is felt most keenly in Western Europe, the most developed e-commerce market in Europe. Western Europe accounts for 70% of the total e-commerce value in Europe and subsequently has the highest share of online consumers at 83%. Businesses in this part of the world would suffer greatly from not investing in their logistics and online presence in order to strengthen their e-commerce appeal.

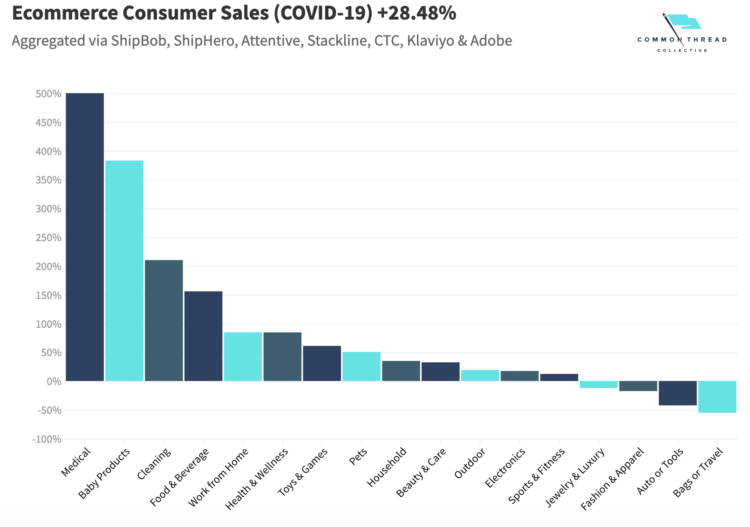

Not every industry felt the benefit of Covid’s effect on e-commerce. The luggage and travel industry suffered somewhat for obvious reasons, whereas items such as medical and cleaning products had a huge rise.

Source: Common Thread Collective

Still, industries in the sectors that have not performed so well is likely due to restrictions caused by lockdown. It is still likely that these industries will feel a digital boost once the pandemic is over.

Coinciding With The Growth Of Online Payment Options

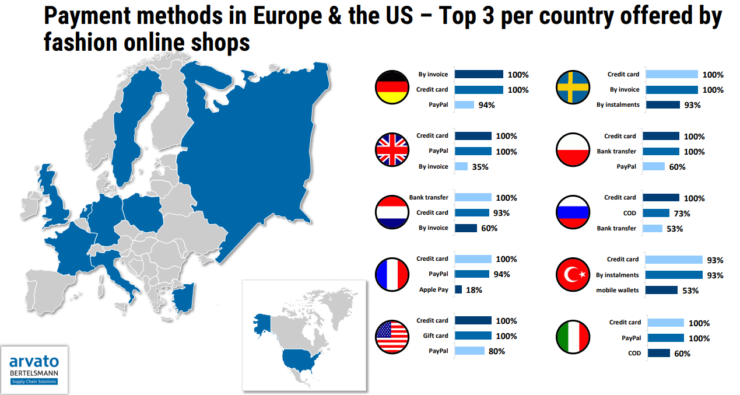

The increase in online shopping has also seen a rise in our use of online payment options, such as Paypal. Data from AirNow has shown that the UK uses Paypal more than any other European country, with over 330,000 daily users. Germany and France make up the rest of the top 3, with over 312,000 and 96,000 daily users respectively. These standings make sense when one considers the fact that these 3 countries are the 3 biggest e-commerce markets in Europe.

One of the main reasons for Paypal’s success over competing methods is the fact that it is open for payments across borders. Traders who conduct a lot of overseas business would do well to keep this in mind.

Klarna is another online payment option that has seen increased popularity due to the pandemic. As more and more of us flocked online to do our shopping, retailers reacted by investing in the digital market to comply with the increased demand by offering easier payment methods.

Source: E-commerce News Europe

The Netherlands One Of The Countries Who Are Capitalising On The New E-commerce Opportunities

This year, the top 250 e-commerce companies in the Netherlands have generated revenues worth 14.4 billion euros in revenue. That’s an increase of 20% from last year.

The country is clearly attempting to attract a wider International market, as is evidenced by companies such as De Bijenkorf expanding. Earlier this week the company announced plans to launch an e-commerce site in France, after already doing so in Belgium and Germany.

It is interesting that Dutch consumers have shown a clear preference to buy from domestic e-commerce stores. Reports have shown that 95% of Dutch consumers prefer to shop at domestic e-commerce site, a trend that is also seen in Poland (94%).

Whilst the Netherlands have clearly taken steps in an attempt to address this with the launch of their new Trustmark, Shopping Secure, traders looking to expand to other countries need to consider statistics like these when considering which markets to expand into. For example, in Russia consumers are far less like to pay with digital payment methods, and usually pay at the door when they receive a product from online. Business owners should make sure their e-commerce is adapted to each individual country.

Conclusion – Should You Shift Your Business Online?

Arguably, statistics suggest that the industry you’re in is a big factor to consider when deliberating on whether or not you should be adapting your selling methods. However, there is a clear shift toward e-commerce in every country and major business, and it is expected that the repercussions from the pandemic will be felt even more over the next decade.

As can be seen in the UK, huge retailers such as Marks & Spencer and Sainsbury’s have already announced plans this week to invest more in their e-commerce. Thus, it is possibly wise to follow the industry leaders who are clearly showing a shift towards e-commerce, as in uncertain times those who are forward thinking and look ahead are usually rewarded.

In what ways has your business been affected by the Coronavirus? Let us know in the comments section below, or by sharing this article on social media!

If you are a business who participates in cross border e-commerce, we would be more than happy to help you register for VAT, file your VAT returns, and help you comply with VAT in case your account faces any issues. At J&P, helping small businesses is our passion, and we understand that companies across the UK are at risk now more than ever. We are here to support you through the Coronavirus crisis, so please do not hesitate to give us a call on 0161 637 1080 or send an e-mail to enquiries@jpaccountant.com.

Business: “A Tough Winter Ahead”: What Help The Government Is Offering For Your Business

For most, this last year has been one of the most unsettling in our lives. Not only have we had to endure worrying about the health of family and friends, as well as our own, but also many have had severe financial worries. The Government’s communication has not always alleviated this burden, since a lot of it has been confusing and unspecific. This article will outline the help that your business can expect to receive from the government during the second lockdown, and what plans have been put in place in order to protect your livelihood.

Employee Retention Scheme Extended

The key aspects of the Coronavirus Job Retention Scheme (CJRS) will remain the same; furloughed employees will receive 80% of their salary up to a maximum of £2,500. Just as before, businesses will be paid upfront to cover wages costs. There will be a short period where changes to the legal terms of the scheme and updates to the system will have to take place, and businesses will be paid in arrears for that period.

However, the scheme has been altered slightly to make it easier for employers to retain their employees. Now, employers will have more flexibility in deciding whether to furlough their staff full time or on a flexible part-time basis – in other words, it is now easier for an employer to have their staff work part of their hours, and the scheme will pay for the hours an employee misses.

Further, under the extended scheme employers will only be asked to cover National Insurance and employer pension contributions which, for the average claim, accounts for just 5% of total employment costs.

Businesses Forced To Close Will Now Also Be Entitled To Receive Grants

In addition, premises forced to close will now be eligible to receive grants of up to £3,000, depending on the size of the business:

- For properties with a rateable value of £15k or under, grants to be £1,334 per month, or £667 per two weeks;

- For properties with a rateable value of between £15k-£51k grants to be £2,000 per month, or £1,000 per two weeks;

- For properties with a rateable value of £51k or over grants to be £3,000 per month, or £1,500 per two weeks.

These grants will be handed out by local authorities, so if you think you may be eligible you should see what information is available on your local council website.

Also, if you are in the hospitality sector please remember that the reduction of VAT for hospitality and tourism is still in effect. This means that establishments only need to pay 5% VAT on food and drink sold on the premises (alcohol is exempt) or ordered for takeaway. This also applies for admission to tourist attractions, and this initiative will last until 12th of January 2021.

Self-Employed Getting a Boost

For self-employed sole traders, the government has announced the Self-Employment Income Support Scheme. The scheme will run for two 3-month periods, the first running from November 2020 to January 2021 and the second from February 2021 to April 2021.

For the first 3 months, the government will provide a taxable grant covering 55% of average monthly trading profits for 3 months. The 55% derives from the fact that the government will pay 80% of profits for November, in order to keep this scheme in line with the Employee Retention Scheme, and then 40% for the two remaining months. This will be capped at £5,160 in total.

The government will review the scheme before the second grant and then reveal the amount for the second instalment of the grant in due course.

If you would like to claim, please be aware that the online service for the next grant will be available from 30 November 2020. Keep an eye on HMRC’s communications, as full details about claiming and applications will be released over the coming weeks.

Conclusion – What You Should Do Now

Hopefully the above information has been helpful. If you need to claim for any of the schemes above you can do so through the Governments website or, in the case of the grant for businesses forced to close, your local council’s website. Please bear in mind that you don’t have to have had used the previous Work Retention Scheme in order to use the new one. If you want more information on how the pandemic has affected VAT and other tax issues, please read our previous post here.

In what ways has your business been affected by the Coronavirus? Let us know in the comments section below, or by sharing this article on social media!

If your small business has been impacted negatively by Coronavirus, please do not suffer in silence – at J&P, helping small businesses is our passion, and we understand that companies across the UK are at risk now more than ever. We are here to support you through the Coronavirus crisis, so please do not hesitate to give us a call on 0161 637 1080 or send an e-mail to enquiries@jpaccountant.com.

E-commerce: Danish supermarket Nemlig expands delivery service

Top online Danish supermarket Nemlig has expanded its operations across Denmark and will be opening new delivery areas in Central and Eastern regions of the country. As part of this expansion, Nemlig will also introduce a delivery method in which customers do not need to be at home and groceries can be left at their door. Because of these new flexible delivery options, Nemlig expects to deliver to more than 4 out of 5 households in Denmark.

J&P Comments

With the expansion of Nemlig’s operations across Denmark and the introduction of more flexible delivery methods, more households will be able to access groceries easily. This is particularly important during Europe’s coronavirus lockdown as many people are finding it difficult to buy essential items.

E-commerce: Amazon launches designer fashion store ‘A Common Thread’ to support independent brands

Amazon has partnered with the Council of Fashion Designers of America (CFDA) and Vogue to launch ‘A Common Thread’, a designer hub which will sell items from independent retailers. The platform is designed to help designers whose revenues have been impacted negatively by the coronavirus crisis. Brands who sell on the platform are able to set their own prices and can pay Amazon a referral fee if they want Amazon to take responsibility for fulfilment and shipping.

J&P Comments

Like Amazon, Alibaba has also launched its own fashion platform ‘Luxury Soho’. It is positive that both leading E-commerce platforms are fuelling these initiatives to help fashion brands at a time that is especially difficult for this sector.

E-commerce: French E-commerce market to be valued at €115.2 billion this year

A report published by retail analysis organisation RetailX has demonstrated that E-commerce in France will be worth €115.2 billion by the end of 2020. As French E-commerce was worth €103.4 billion last year, this is an expected increase of 11.4%. The report also detailed that E-commerce will account for 4.63% of France’s Gross Domestic Product (GDP) and that the average online shopper will spend €2,428 this year. It was also revealed that a massive 53.7% of French internet users have used Amazon in 2020.

J&P Comments

Although E-commerce in France is expected to increase by 11.4% this year, this is still a decrease in growth in comparison to recent years – in 2019 the French E-commerce market increased by 11.7% and in 2018 it increased by 13.3%.