From 2018, the HMRC began to gradually implement the joint and several liability policy of a VAT representative, and strengthened VAT collection efforts and measures to overseas online selling traders.

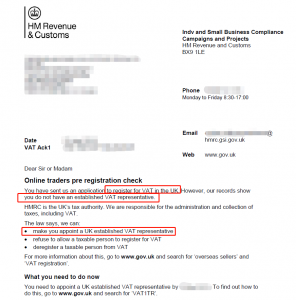

Recently, some sellers have received inquiries about “appointing a UK VAT tax representative ” (particularly note, not a “tax agent”). When they applied to register for a UK VAT, they received a notification letter from HMRC requesting them to accept the “VAT pre-registration review” and appoint a VAT tax representative. To have a better understanding of this policy, our UK accountant also contacted HMRC’s VAT Registration Officer to answer the following questions.

What is the difference between VAT Representative and VAT Agent?

The major difference is that HMRC cannot hold your agent responsible for any of your VAT debts. Whilst an agent can help you with your application process, the can not act as a guarantor for your VAT debts.

Why appoint a VAT tax representative? People often ask, “Can I forego appointing a tax representative?”

Under certain circumstances, it is possible. If you do not appoint a VAT tax representative, as a taxpayer, you must handle all matters with the UK Tax Office by yourself, such as registering for VAT in time, keeping all transaction data, filing and paying all taxes on time and, when the tax office asks, provide the requested data.

However, according to legal requirements, HMRC has the right to require you (especially overseas sellers) to appoint a VAT tax representative, otherwise it will not accept any UK VAT application.

When do I need to appoint a VAT tax representative?

As long as HMRC has not directed you to appoint a tax representative, you can appoint an agent to deal with your UK VAT affairs. Any arrangement you make will be subject to whatever contractual agreement you and your agent decide.

However, HMRC reserve the right not to deal with any particular agent you may choose to appoint. In some circumstances, if HMRC think it’s necessary, they may still insist that you appoint a tax representative.

HMRC will inform you that you must fill the VAT1TR form to appoint a UK VAT representative.

How to appoint a VAT tax representative?

An overseas company designated by HMRC to appoint a VAT tax representative must find a tax representative on its own. The tax representative must be a local organization in the UK and must meet the requirements for being a representative (VAT Notice 700/1, S1 & HMRC: the standard for agents). Your appointed representative needs to fill out a special form (VAT1TR) and might need to provide a survey letter (High Risk Traders Import Questionnaire).

These two documents must be mailed to the relevant department of HMRC together, and a scanned copy must be sent to their designated mailbox.

If I want to appoint a VAT tax representative, are there any special considerations?

After receiving the notification document from HMRC, you need to respond to HMRC within seven days to confirm who is your appointed VAT tax representative and provide them with the two designated documents.

It is important to note that the HMRC normally does not accept any extension applications here. If there is no response within the prescribed period, the tax authority will reject your VAT application and may not consider accepting your second application.

J&P Analysis

Now for overseas VAT applicants, HMRC requires them to appoint a tax representative who can bear joint liability. This is not an easy task in the UK, but this is not a novelty.

Obviously, this measure is imperative. First of all, in terms of the application rules of VAT itself, in fact, when registering for VAT, the application form VAT1 already requires the applicant to provide the detailed information of the VAT tax representative or VAT tax agent. If in this context, you did not choose a VAT tax representative, then HMRC may write to you again, requesting you to appoint a VAT tax representative (see the official requirement below).

Furthermore, from the perspective of the VAT tax representative measures, some EU countries have already implemented this policy. For example, cross-border sellers who register to apply for an Italian VAT number should know that only after paying a certain amount of deposit to the tax representative, your application can be submitted to the Italian Tax Agency.

From the current VAT policy, since March 2018 the UK has implemented joint liability clauses for all e-commerce marketplaces. In 2019, HMRC began to randomly require some overseas VAT applicants to implement VAT Representative measures.

Finally, it is worth bearing in mind that the UK Revenue Service lost approximately £1.5 billion in taxes in 2017 due to e-commerce VAT fraud. Recently, HMRC has released a blacklist of overseas tax evaders. At the top of the list is a overseas company with a VAT debt of several million pounds. Faced with such a severe situation and under pressure from all walks of life, the British tax authorities have been perfecting and implementing various tax supervision and tax inspection policies.

J&P Help

In our further communication with the UK Tax Office, it was confirmed that the current VAT tax representative policy is only selective verification and implementation, and it is only implemented for some overseas new VAT applicants.

However, it particularly emphasized that this policy will be implemented in existing overseas VAT registered enterprises in the near future and the VAT tax representative policy will gradually become more and more common. In order to avoid complicated procedures and to get your UK VAT registration as soon as possible, we still encourage everyone to register and declare UK VAT as soon as possible.

J&P is a registered accounting firm in the UK. We have the qualifications and strength to help you plan ahead, so please do not hesitate to get in touch at enquiries@jpaccountant.com should you have any further questions about this policy, or if you need any help with your applications to register for VAT.