The coronavirus crisis is taking its toll on the UK economy and in particular small businesses. As a response, the government has announced that grants have been made available for small businesses and will be provided by the local authorities.

In particular businesses within the following categories will take priority:

- Businesses with less than 50 employees

- Businesses in the retail, hospitality and leisure sectors

- businesses in shared spaces

- regular market traders

- small charity properties that meet the criteria for Small Business Rates Relief

- bed and breakfasts that pay council tax

In this article, we will demonstrate the types of Small Business Grant scheme that are currently available, who is eligible to receive a grant and how to apply for a grant.

What are the grants that are currently available?

The two types of grants available for small businesses are:

- The Small business grant fund (SBGF)

- Retail, Hospitality and Leisure Grant (RHLG)

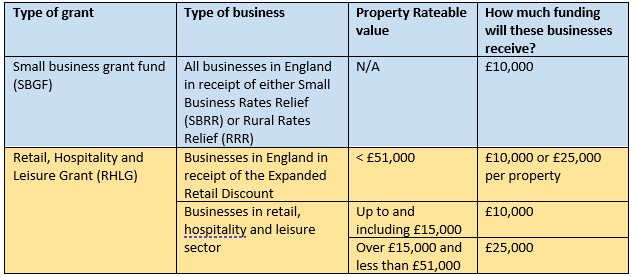

How much funding will be provided?

The table below demonstrates how much each type of business will be eligible to receive depending on the type of grant that is being provided and the rateable property values of the business.

Who is eligible for a grant?

You are eligible for a Small business grant fund (SBGF) if:

- Your business was eligible for the Small Business Rate Relief (SBRR) scheme on 11 March 2020 – this includes businesses who have properties with a Rateable Value between £12,000 and £15,000 who receive tapered relief

- Your business was eligible for the Rural Rate Relief Scheme on 11 March 2020

You are eligible for a Retail, Hospitality and Leisure Grant (RHLG) if:

- On 11 March 2020 your business property had a rateable value of less than £51,000 and would have been eligible for a discount under the Expanded Retail Discount Scheme

What is excluded in these grants?

You cannot get a Small business grant fund (SBGF) for the following property types and spaces:

- Properties for personal uses

- Private stables and loose boxes

- Beach huts

- Moorings

- Car parks and parking spaces

You cannot get a Retail, Hospitality and Leisure Grant (RHLG) for:

- The same property types and spaces specified above

- Properties with a rateable value of £51,000 or more

Important points to remember

- Eligible recipients will receive one grant per property

- Businesses who were in liquidation or dissolved on the 11 March will unfortunately not be eligible for a grant

- Recipients are unable to receive SBGF and RHLG on the same property

How can I apply for a grant?

As these grants are provided by the local authorities, your local authority will contact you once they have the money available. If your business is eligible, they will get in touch to arrange the payment of the grant. This will usually be via post.

If you do not get contacted by your local authority but believe you are eligible for a grant, it may be a good idea to check your local authority’s website for updates or contact your local authority directly.

Frequently asked questions about small business grants

Q: Are these grants taxable?

A: Yes. As the grants are classed as income, you are required to calculate and pay tax on them.

Q: Are there any conditions I need to be aware of with this grant?

A: Any businesses who accept this grant need to confirm they comply with state aid requirements and they must provide information requested by their local authority to support monitoring and assurance

Q: If I have more than one property for my business, can I claim a grant for each property?

A: Under the Small business grant fund, unfortunately not – you are only allowed one grant. However, when in receipt of the Retail, Hospitality and Leisure scheme businesses can claim one grant for each eligible property.

Q: Will I need to repay my grant if I vacate the business property?

A: No, you do not need to repay your grant if you are no longer using the property.

Q: What about when the pandemic is over? Will I have to repay my grant then?

A: Unlike corporate loans, you are not required to repay your grant as long as your business is eligible and you comply with the rules.

Q: What if I have a Retail, Hospitality and Leisure business but I receive Small Business Retail Relief? Would I get a Small business grant fund or a Retail, Hospitality and Leisure Grant?

A: If you have a Retail, Hospitality and Leisure business but you are in receipt of Small Business Retail Relief, you will only be able to claim a grant of £10,000.

Q: My business operates without a physical premise. Am I still eligible?

A: Unfortunately not – grants can only be made to businesses with a physical property.

Q: If I don’t want funding and I get a letter from my local authority saying I am eligible, can I opt out?

A: Yes, you can decline the grant.

Still confused about Small Business Grants?

At this difficult time many businesses are under pressure and are at risk of closing, so it is key that you get the advice and guidance your business needs. We are here to support you through the coronavirus crisis, so please do not hesitate to give us a call on 0161 637 1080 or send an e-mail to enquiries@jpaccountant.com.