Christmas Approaching Quickly For Ecommerce Sellers

It seems like the Christmas decorations in shops and ‘All I want For Christmas Is You’ are forced upon us earlier and earlier each year. Whilst this is irritating for the general public, who may also think that late September is far too early to be thinking about...

VAT Registration: Is Italy The Next Big Market?

Italy has always presented a strange proposition for ecommerce sellers. On the one hand, it is no secret that the country lags behind some of the bigger ecommerce markets in Europe such as the UK and France. However, it is one of the fastest growing ecommerce markets...

Ebay Seller Update Autumn 2021: All You Need To Know

The Ebay Seller Update Autumn 2021 was released last week. For the most part, sellers are likely to welcome the changes. The most noteworthy changes have come in the form of multi-user account updates, improvements to Ebay coded coupons and Ebay shops. The update also...

UK Food Industry Takes £2 Billion Hit From Brexit

The UK food and drink industry is about £2 billion worse off than it was before Brexit, new figures have shown. The reports come from the Food & Drink Federation, who have analysed the trade of food and drink between the UK and EU in the first 6 months of 2021....

How To Complete VAT Registration In Spain

Regular readers of our articles will be aware that we have done a handful of guides for VAT registration in various countries. This time we’re going to be looking at VAT registration in the 9th biggest country in the world – Spain. Ecommerce in Spain is currently...

National Insurance Increase Imminent

If recent reports are to be believed, Boris Johnson is set to announce an increase of 1-2% to national insurance payments, despite this being a direct contradiction to the promises made in the 2019 Tory manifesto. It is believed the plans will be announced next week,...

How To Understand Cryptocurrency & VAT

Cryptocurrency has been one of the most widely discussed topics in the business sector for the last decade. What originally seemed like an outlandish investment scheme has now become a mainstream currency, with more and more people investing in the likes of ‘Bitcoin’...

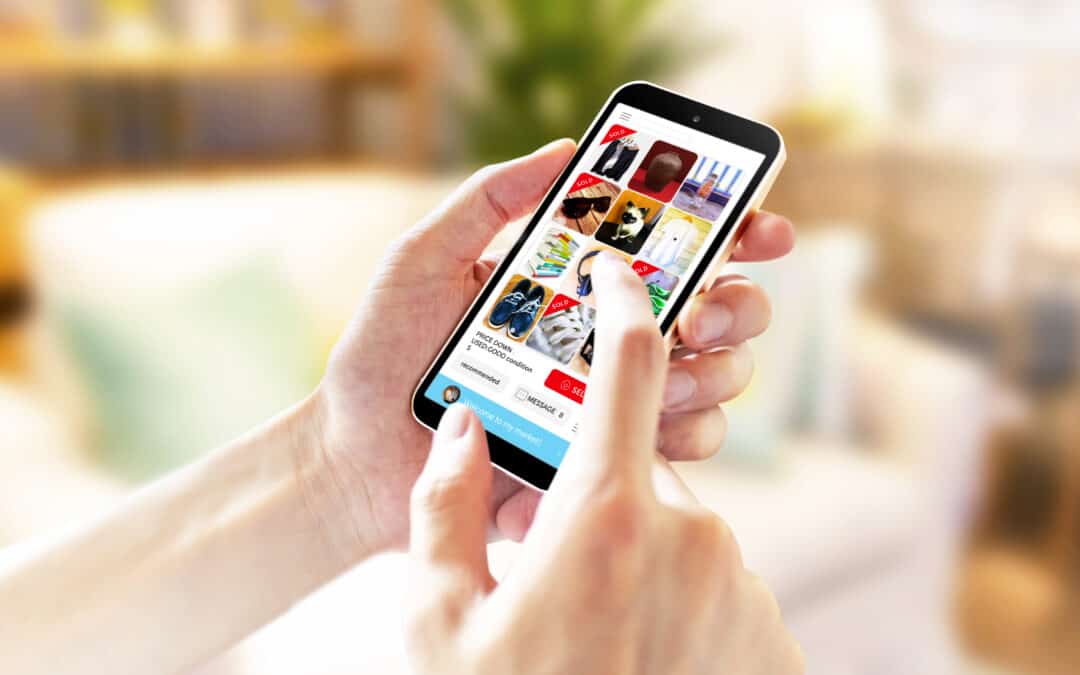

Is Social Media The Future Of Ecommerce?

Nowadays, most companies and ecommerce providers will have a social media presence. The potential for exposure, branding, and the relatively low cost of maintaining a social media page has seen many sellers use it as a valuable marketing channel. However, what is...

HMRC Researches Chinese Cross-Border Sellers

HMRC have recently released the results of research that they have conducted into Chinese cross-border selling into the UK. The research came in the form of detailed interviews with Chinese ecommerce cross-border sellers, and has been titled ‘Knowledge and Attitudes...

Alibaba & WorldFirst Offer Hand To UK SMEs

The collaboration gives UK sellers the chance to reach 15 million buyers from 200 countries and regions via the Alibaba platform.