HMRC and daft excuses for late submissions of your self-assessment tax

What happens We all know this situation. The tax calendar has been betraying us, and the HMRC is somewhat unforgiving. There was this birthday, then there was the weekend. However, HMRC does not like late submissions, nor late tax assessments. So, when it comes to...

Standard Audit File for Tax: What is it & where is it?

In order to avoid tax fraud and increase the accuracy of VAT reporting, tax administrations around the world are adopting an electronic invoicing system which enables tax authorities to have a consistent approach to managing tax audits. This system is known as the...

DHL Discontinues Delivery of ‘Amazon Fresh’ Food in Germany

International courier DHL has confirmed that they have ended their delivery service for ‘Amazon Fresh’ in Germany. This is due to the fact that there has been little demand for being able to order fresh food online, and ‘Amazon Fresh’ has been growing at a very slow...

Deliveries from Sweden to Finland take 5.6 days

The time-scale for parcels to be transported from Sweden to Finland is 5.6 days, and almost two of those days (1.8) are spent in Finland once the parcel has crossed the border. Cross-border purchases made by Finns on Swedish online stores are becoming popular, as...

Deliveroo says “Auf Wiedersehen” to Germany

Deliveroo announced that they will be exiting the German market on 16th August. After just four years of operating in Germany, the UK delivery firm wants to focus on growing its operations in other international markets. In 2015, the company expanded for the first...

Digital Marketplaces in Austria will be required to keep records of third-party transactions

From 1 January 2020, it will be mandatory for digital marketplaces in Austria to keep detailed records on transactions that have been made on the platforms by third-party sellers. These records will need to be submitted to tax authorities on an on-request basis, when...

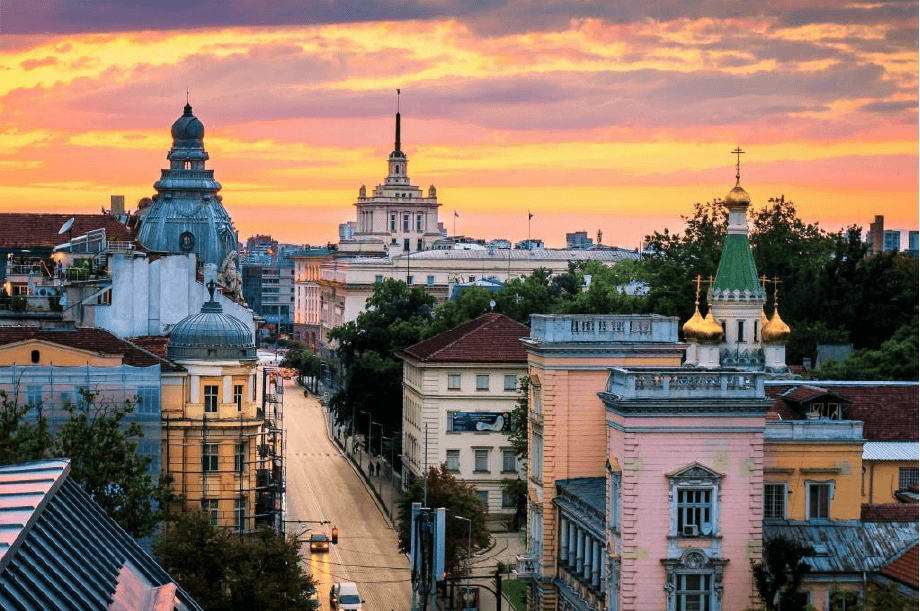

Bulgaria to Raise VAT Registration Threshold to BGN 100,000

European traders who sell products cross-border to Bulgaria will know that the current threshold for VAT registration in the country is BGN 50,000. These merchants will have registered for Value-Added Tax in Bulgaria if their sales to the country exceeded BGN 50,000....

British Supermarket Morrisons partners up with Amazon and Deliveroo

British Supermarket Morrisons has partnered up with Amazon and Deliveroo to fulfil their deliveries after loosening ties with Ocado. Deliveroo has partnered with Co-Op and other smaller convenience stores in the past, but competition remains high amongst its...

DHL Introduces Drone Deliveries in China

International express delivery service DHL has partnered up with an autonomous aerial vehicle firm to launch an automated smart drone delivery service in China. The new intelligent drone delivery solution will operate in urban areas and overcome complex road...

Denmark Left Out Of Pocket Due To Technical Issues at Tax Authority

Due to several years of technical problems at Danish tax authority Skat, the tax authority is now greatly in debt to the state of Denmark. The overall debt that Skat owes totals at 117 billion kroner. Economics professor at Aalborg University, Per Nikolaj Buch, has...