News Hub

Deliveroo says “Auf Wiedersehen” to Germany

Deliveroo announced that they will be exiting the German market on 16th August. After just four years of operating in Germany, the UK delivery firm wants to focus on growing its operations in other international markets. In 2015, the company expanded for the first time internationally where they launched its platform in Paris and Berlin. And, then soon after Germany, which took a downturn when they were made to shut down services in several small German cities.

J&P Comments

Deliveroo departure is unfortunate; however, from a business perspective, it makes sense to leave a market that no longer serves it any purpose, rather than exhausting its efforts and expenditure on a market that it is struggling to sustain. Last year, Delivery Hero was another food delivery service that exited Germany due to a tight market.

Digital Marketplaces in Austria will be required to keep records of third-party transactions

From 1 January 2020, it will be mandatory for digital marketplaces in Austria to keep detailed records on transactions that have been made on the platforms by third-party sellers. These records will need to be submitted to tax authorities on an on-request basis, when tax authorities request information from the marketplaces such as seller details, values of transactions and VAT liabilities of sellers.

J&P Comments

Austria is not the only EU country that will soon be required to report details on transactions made by third-party sellers – from 31 October, online marketplaces in Italy will need to submit this information to tax authorities on a quarterly basis. These new requirements are effective ways of preventing VAT fraud from taking place in European E-commerce.

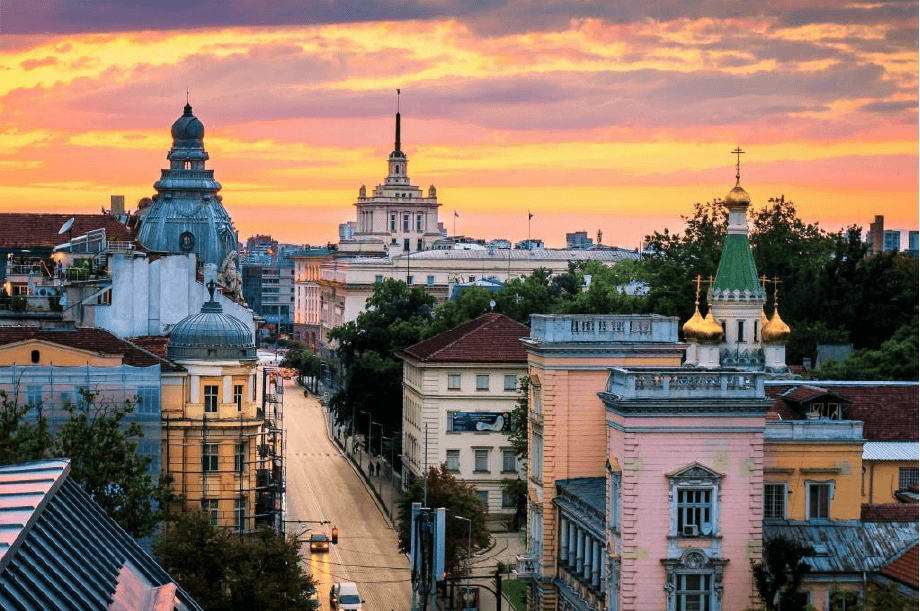

Bulgaria to Raise VAT Registration Threshold to BGN 100,000

European traders who sell products cross-border to Bulgaria will know that the current threshold for VAT registration in the country is BGN 50,000. These merchants will have registered for Value-Added Tax in Bulgaria if their sales to the country exceeded BGN 50,000. However, The Bulgarian government has recently announced that the current threshold of BGN 50,000 will be raised to BGN 100,000. This new threshold applies from 1 January 2019. In addition to this change, a new reduced VAT rate of 5% will be introduced, which will apply to basic food stuffs.

British Supermarket Morrisons partners up with Amazon and Deliveroo

British Supermarket Morrisons has partnered up with Amazon and Deliveroo to fulfil their deliveries after loosening ties with Ocado. Deliveroo has partnered with Co-Op and other smaller convenience stores in the past, but competition remains high amongst its competitors, including Uber Eats and Just One, which are continuously adding new features to its services. Amazon will offer one-hour delivery slots for groceries from selected postcodes in London and Hertfordshire. However, one-hour delivery slots will be charged at £6.99, but two-hour delivery slots will be free of charge.

Amazon may fulfil Morrison’s big shopping orders, while Deliveroo solely focuses on delivering smaller orders.

DHL Introduces Drone Deliveries in China

International express delivery service DHL has partnered up with an autonomous aerial vehicle firm to launch an automated smart drone delivery service in China. The new intelligent drone delivery solution will operate in urban areas and overcome complex road conditions and congestion. Furthermore, it will reduce delivery time from forty minutes to eight minutes; minimize energy consumption and carbon footprint compared to vehicles and save up to 80 per cent per delivery.

Denmark Left Out Of Pocket Due To Technical Issues at Tax Authority

Due to several years of technical problems at Danish tax authority Skat, the tax authority is now greatly in debt to the state of Denmark. The overall debt that Skat owes totals at 117 billion kroner. Economics professor at Aalborg University, Per Nikolaj Buch, has said that the figures are “damaging for citizens’ sense of justice”. According to an estimate made by Skat, the 117 billion kroner cannot be recovered, due to individuals being too poor to pay or not paying because the debts are tied to companies that are bankrupt